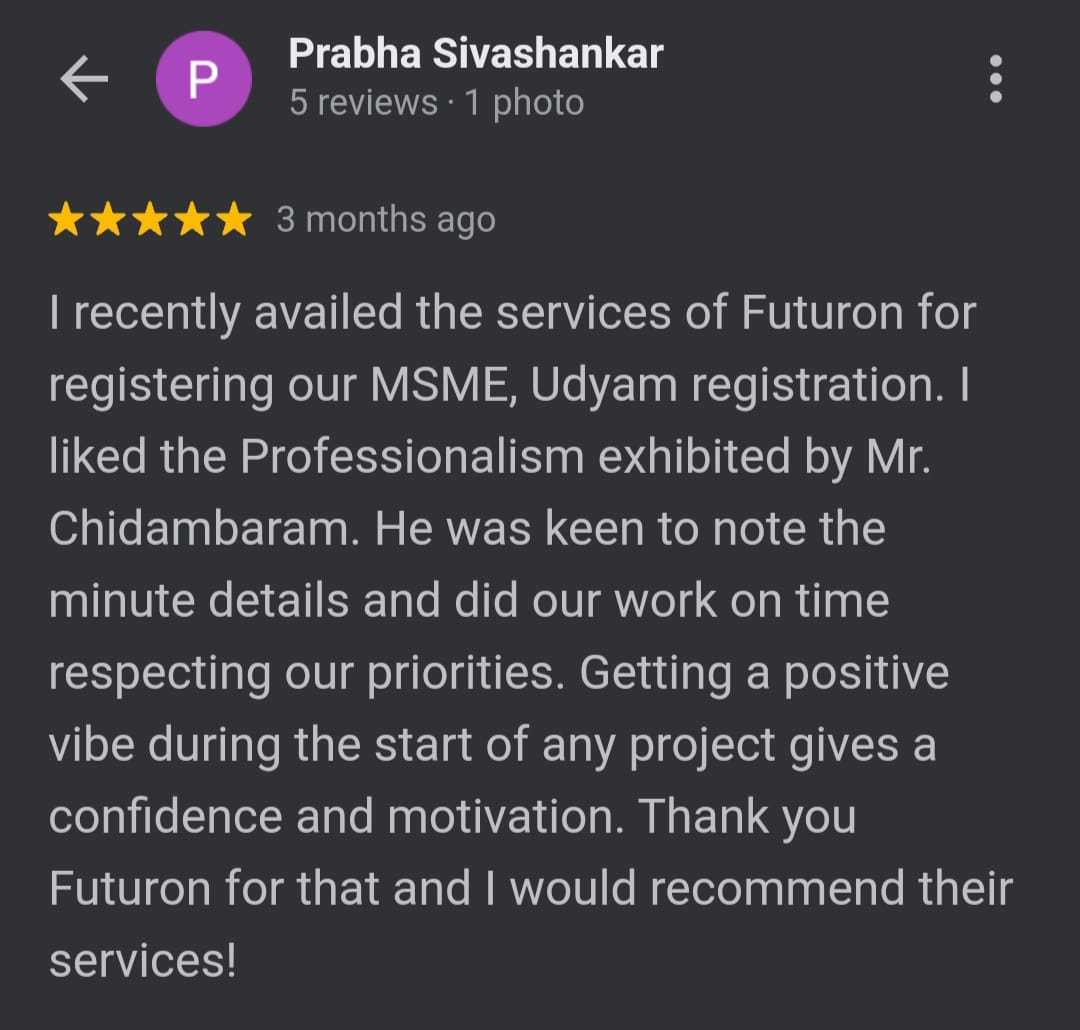

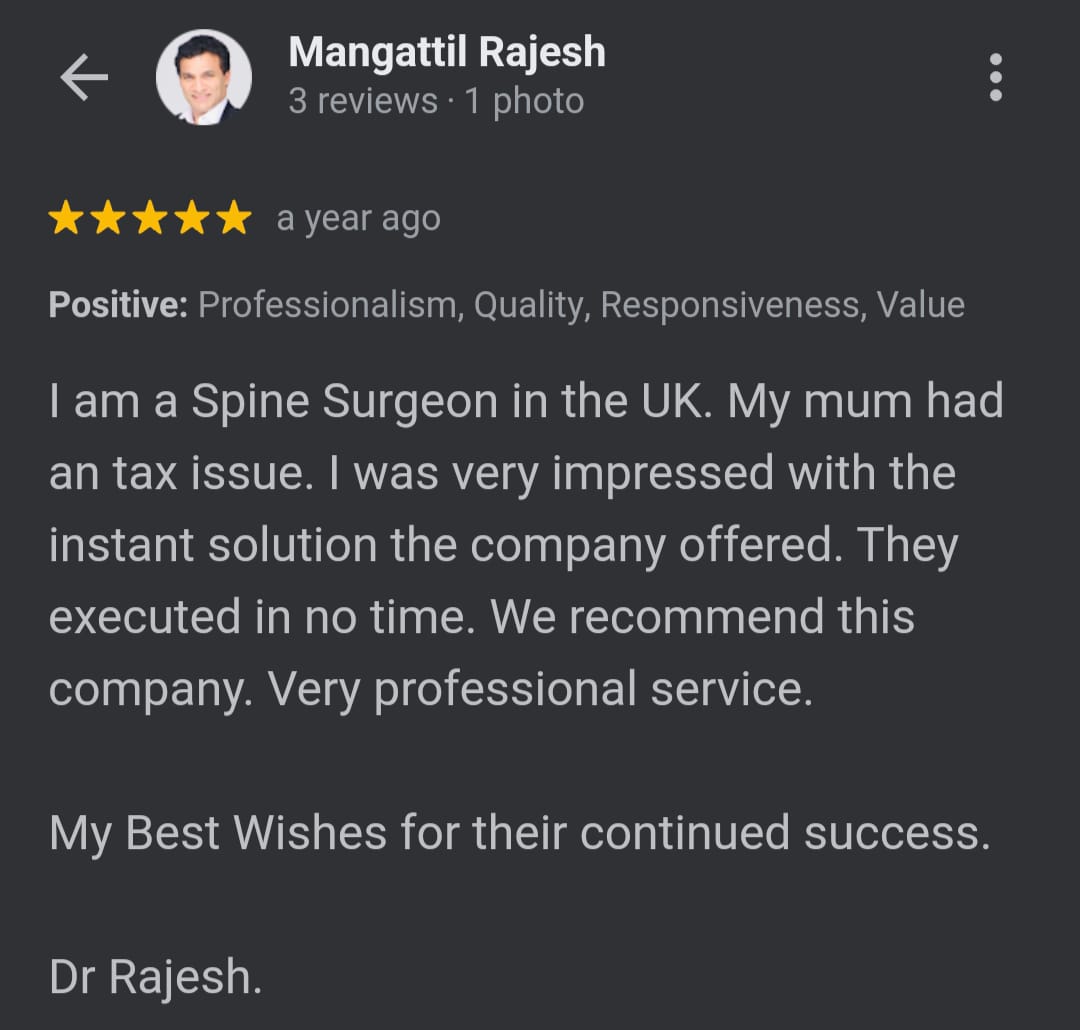

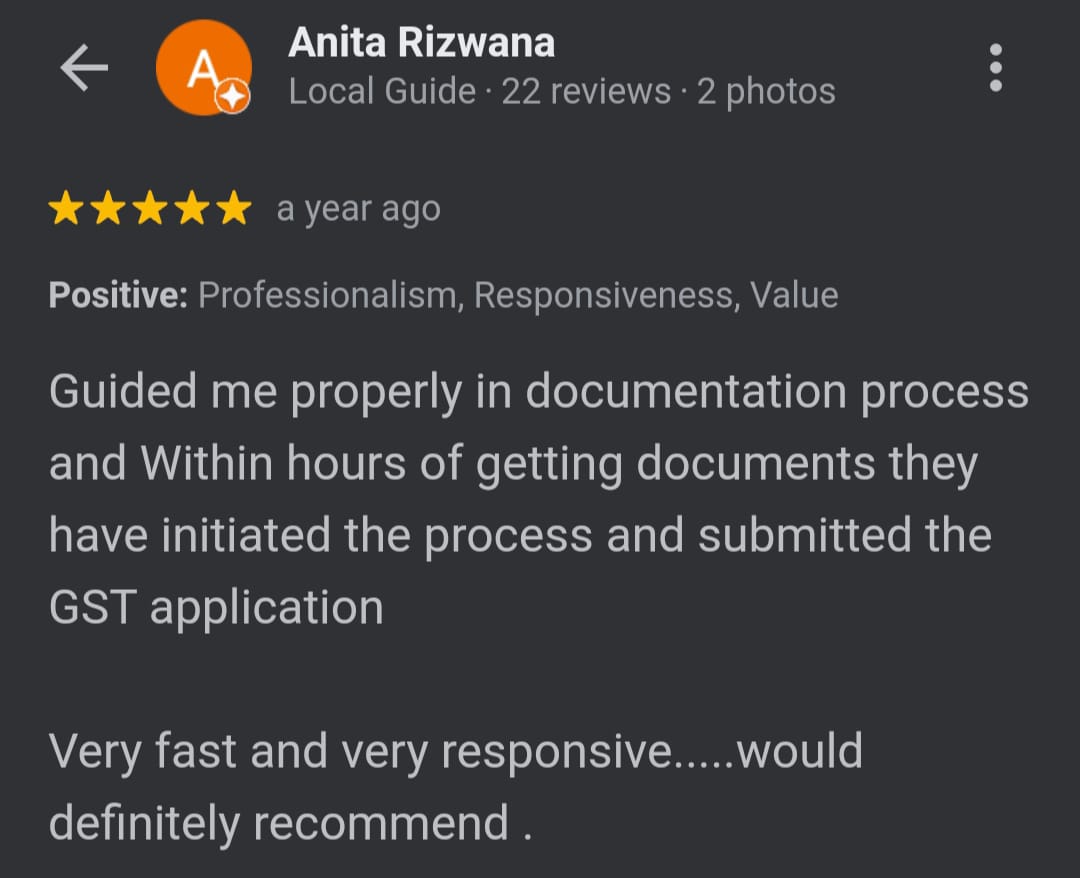

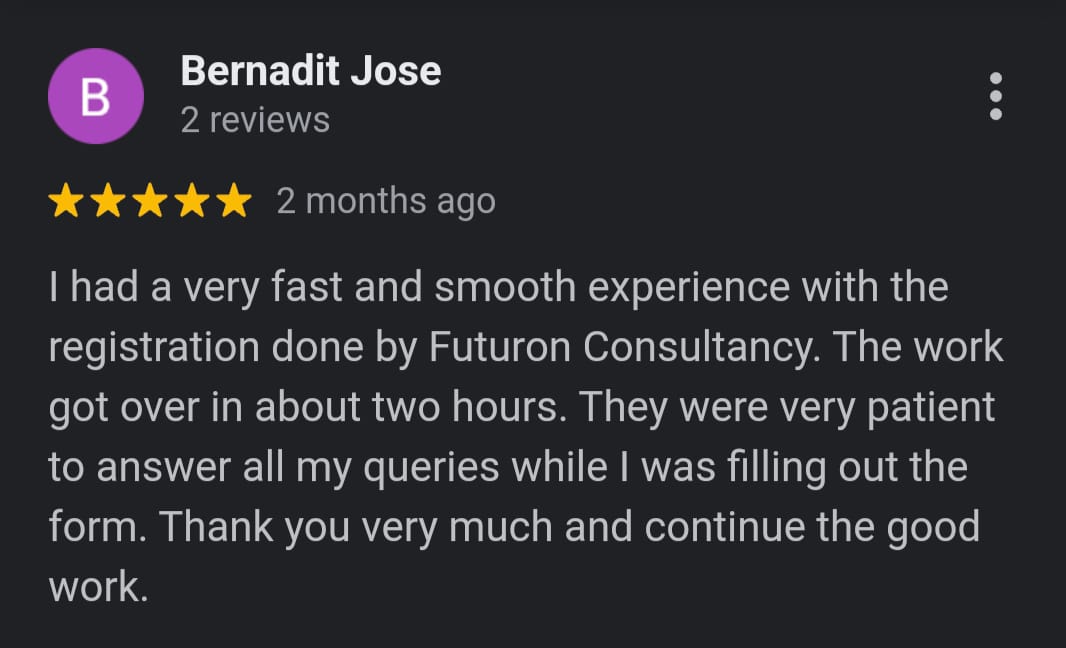

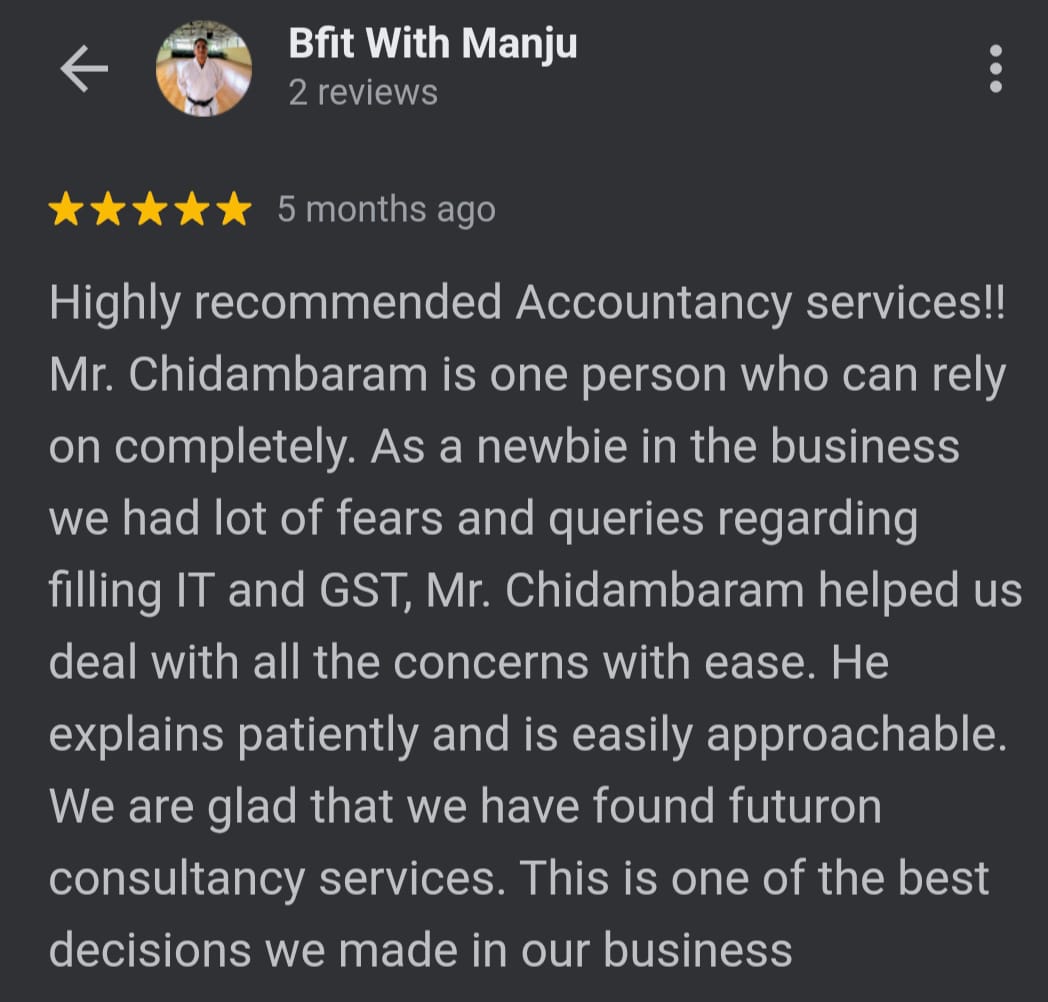

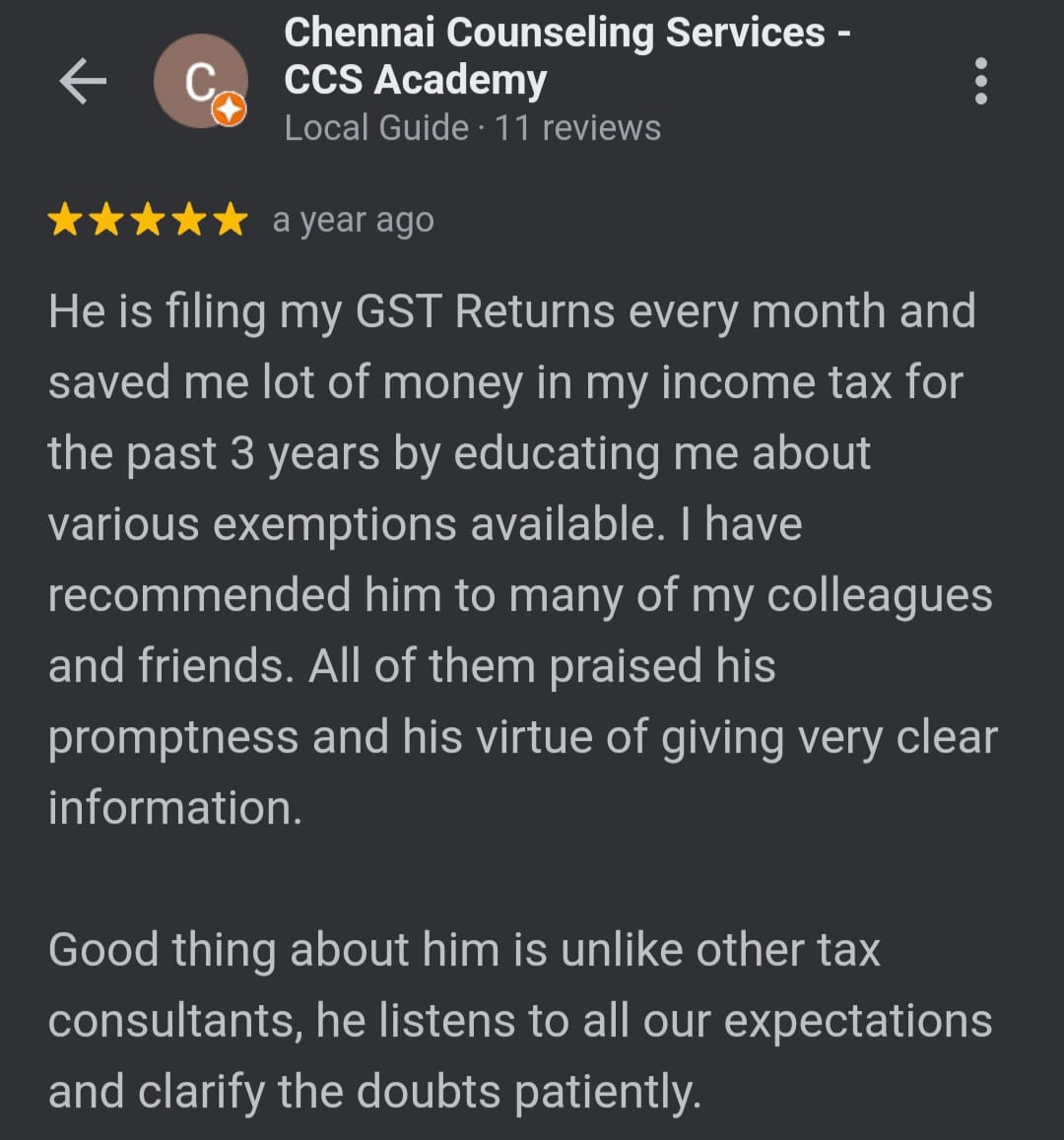

Screenshots of the Google Reviews

We offer the following services for your company

The Income Tax Act, 1961, and the Income Tax Rules, 1962, obligates citizens to file returns with the Income Tax Department at the end of every financial year. These returns should be filed before the specified due date.

Starting from

As per Section 31(1) Food Safety and Standards Act, 2006, every Food Business Operator in the country must be licensed under the Food Safety & Standards Authority of India (FSSAI)

Starting from

Accounting, which is often just called “accounting,” is the process of measuring, processing, and sharing financial and other information about businesses and corporations.

Starting from

An Importer -Exporter Code (IE Code) is a key business identification number which mandatory for export from India or Import to India.

Starting from

As we know, business agreements format are important for businesses of all sizes. An agreement should be clear and specific. Furthermore, it should also meet a few legal criteria for it to be legal.

Starting from

You can get all your doubts clarified with the qualified consultants. All queries related to business, Income Tax, GST management and compliance will be discussed in detail.

Starting from

An investment portfolio is a collection of assets and can include investments like stocks, bonds, mutual funds and exchange-traded funds.

Starting from

When you need a loan, potential lenders may ask to see your audited financial statement

Starting from

Udyam Registration is a Unique Identification Number provided by the Ministry of Micro, Small and Medium Enterprises, Government of India for small and medium enterprises, beginning in September 2015. It is also known as Aadhaar for Business.

Starting from

A GST return is a document containing details of all income/sales and/or expenses/purchases that a GST-registered taxpayer (every GSTIN) is required to file with the tax administrative authorities

Starting from

Under Goods and Services Tax (GST), businesses whose turnover exceeds the threshold limit of Rs.40 lakh or Rs.20 lakh or Rs.10 lakh as the case may be, must register as a normal taxable person. It is called GST registration

Starting from

A GST return is a document containing details of all income/sales and/or expenses/purchases that a GST-registered taxpayer (every GSTIN) is required to file with the tax administrative authorities

Starting from

FAQ

It is mandatory to file ITR if the gross total income of an assesse, be it an individual, Hindu Undivided Family, an association of person (AOP) or a Body of individual (BOI), exceeds the maximum amount not chargeable to tax. Gross total income of a person is the income without considering any exemptions and deductions. The minimum exemption limit for the current year 2019-20 is up to Rs 2.5 lakh for an individual below 60 years. It is Rs 3 lakhs for an individual between 61 and 80 years of age, and Rs 5 lakh in case of individuals who are above 80 years of age.

Even though filing of ITR is not mandatory for some individuals, there are certain benefits that one can avail of provided the ITR has been filed. Here are few of those:

Claiming refund (In case TDS deducted against your PAN )

Processing of documents(In case Applying for bank loan )

Carry-forward of losses( In case of Capital gain losses)

Establishing income proof in compensation cases( In legal proceedings)

Being a law abiding citizen

It is nowhere mandatory to get your returns assisted with some legal professional or institution. You can file all your tax returns by yourself if you have the knowledge of all basic rules and procedures. For those who don’t have a good access to professional tax guides or legal experts, the IT department has appointed small sized subsidiaries/ private individuals to help people file their tax return. They only charge a nominal amount and provide complete assistance in filing.